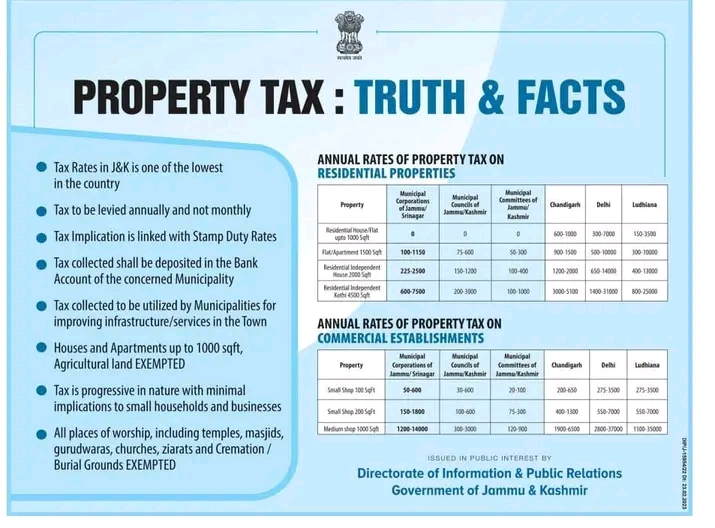

Property tax: Truth and facts Issued by (DIPR JK) Directorate of Information and Public Relation J&K

Check Below ⬇️⬇️⬇️⬇️

Property tax: Truth and facts Issued by (DIPR JK) Directorate of Information and Public Relation J&K

Tax Rates in J&K is one of the lowest in the country

Tax to be levied annually and not monthly Tax Implication is linked with Stamp Duty Rates

Tax collected shall be deposited in the BankAccount of the concerned Municipality

Tax collected to be utilized by Municipalities for Improving infrastructure/services in the Town Houses and Apartments up to 1000 sqft.

Agricultural land EXEMPTED Tax is progressive in nature with minimal implications to small households and businesses All places of worship, including temples, masjids, gurudwaras, churches, ziarats and Cremation/ Burial Grounds EXEMPTED